88YTY News Hub

Stay updated with the latest trends and news.

Diving Deep into Marketplace Liquidity Models: Where Buyers Meet Their Match

Uncover the secrets of marketplace liquidity models and discover how buyers find their perfect match. Dive in for insights that could boost your success!

Understanding the Dynamics of Marketplace Liquidity: Key Models Explained

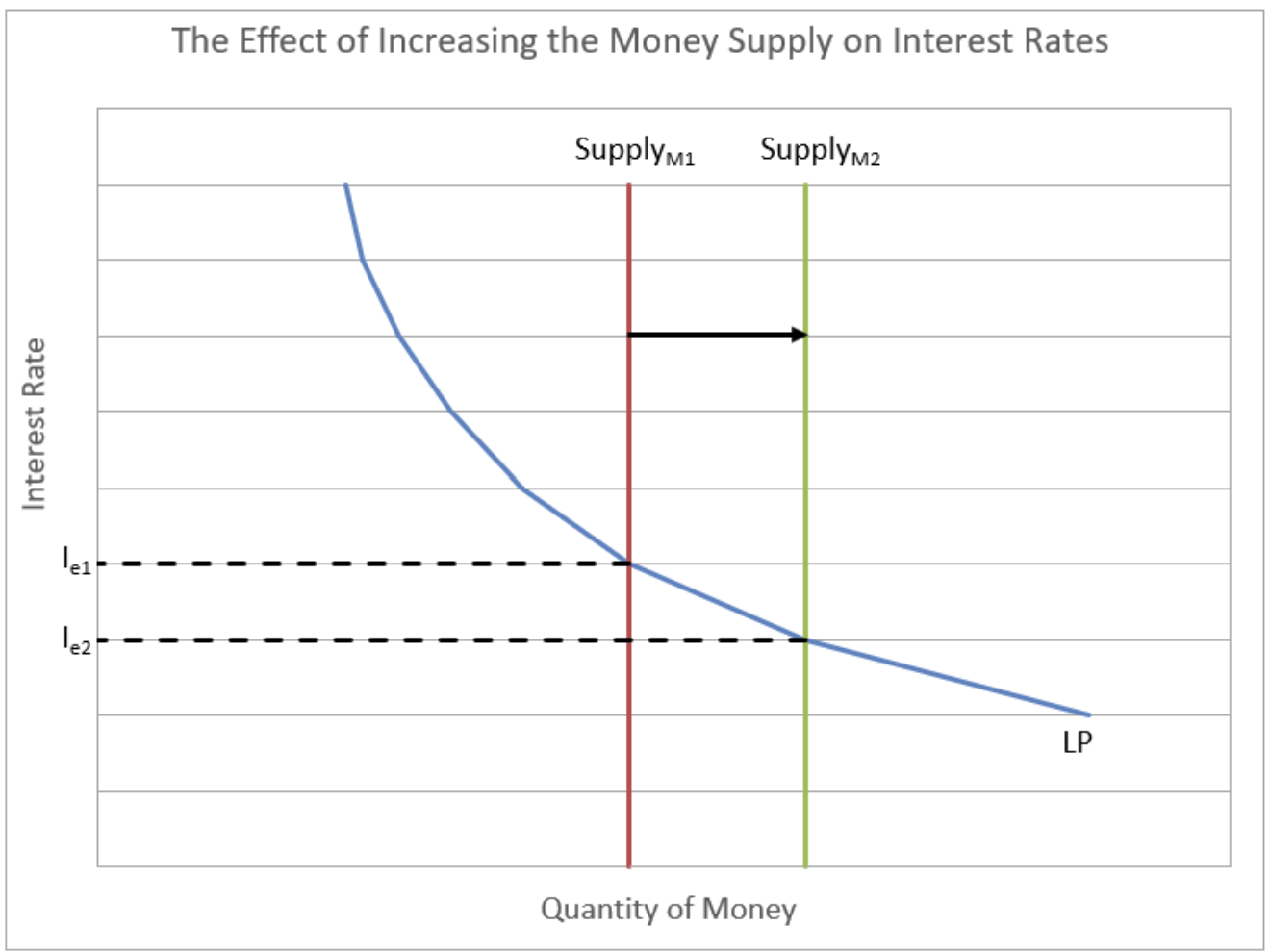

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing a significant impact on their price. Understanding this concept is crucial for traders and investors, as it directly affects market efficiency and trading strategies. There are several models to assess marketplace liquidity, such as the order book model, which details how buy and sell orders are placed, providing transparency about available liquidity levels. Another important model is the price impact model, which examines how large transactions influence market prices, helping traders gauge potential costs during high-volume trades.

One of the key takeaways in understanding marketplace liquidity is the distinction between shallow and deep liquidity. Shallow markets can be highly volatile, where even small trades can cause significant price swings, while deep markets allow for larger transactions with minimal price fluctuation. It’s also vital to consider factors like market depth and spread, which reflect the number of buy and sell orders and the difference between their prices, respectively. By comprehending these models and dynamics, investors can make informed decisions, minimize risks, and optimize their trading strategies.

Counter-Strike is a highly popular first-person shooter game that has evolved significantly since its inception. Players engage in team-based gameplay, where they can choose to be either terrorists or counter-terrorists. To enhance the gaming experience, you can check out the daddyskins promo code that offers exciting in-game benefits and rewards.

How Marketplace Liquidity Affects Buyer-Seller Relationships

Marketplace liquidity plays a crucial role in shaping buyer-seller relationships. When liquidity is high, buyers can easily find sellers willing to transact, leading to faster sales and enhanced trust between parties. Conversely, low liquidity can create bottlenecks, as buyers may struggle to find suitable options, resulting in increased frustration and potential mistrust. This dynamic highlights the importance of a well-functioning marketplace, where sufficient liquidity fosters a smooth buying experience and encourages repeat transactions.

Moreover, the impact of liquidity is not just a one-way street. Buyers can influence marketplace liquidity by actively engaging in transactions and providing feedback on their experiences. Increased activity from buyers encourages sellers to enter the marketplace, enhancing variety and competition. In turn, a diverse range of sellers contributes to higher liquidity, establishing a virtuous cycle that benefits all participants. By understanding this relationship, businesses can strategize effectively to improve liquidity, ultimately strengthening their buyer-seller relationships.

What Factors Influence Liquidity in Online Marketplaces?

Liquidity in online marketplaces is influenced by several key factors that determine how quickly and easily assets can be bought and sold. One of the most significant factors is market depth, which refers to the volume of trading activity within the marketplace. A deeper market typically leads to higher liquidity, as more buyers and sellers are present, allowing transactions to occur smoothly. Additionally, transaction fees can also impact liquidity; higher fees may discourage users from making trades, whereas lower fees can incentivize activity, resulting in improved liquidity.

Another crucial factor affecting liquidity is market demand. When there is strong demand for particular assets, liquidity tends to increase as more participants are willing to engage in buying and selling activities. Furthermore, the dynamics of supply and demand play a vital role; if the supply of an asset is limited compared to demand, liquidity may diminish. Other elements include user experience and the speed of transactions, which can either enhance or hinder a user's ability to trade effectively. Overall, understanding these factors is essential for anyone looking to navigate online marketplaces successfully.