88YTY News Hub

Stay updated with the latest trends and news.

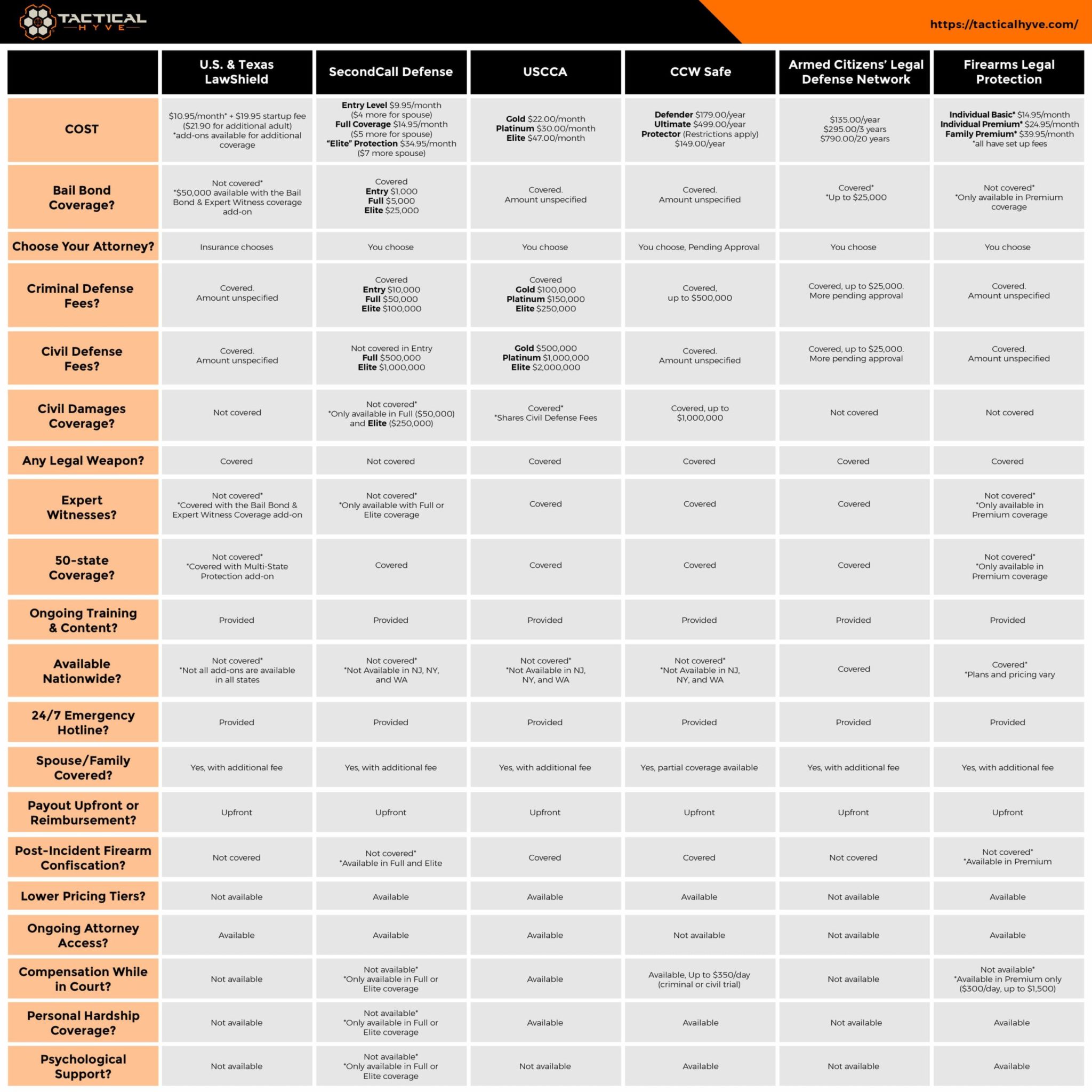

Insurance Showdown: Battle of the Policies

Discover the ultimate guide to choosing the right insurance! Uncover policy secrets in the Insurance Showdown and protect your future today!

Understanding the Key Differences: Term vs. Whole Life Insurance

When considering life insurance options, it's essential to understand the key differences between term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This type of policy is generally more affordable, making it an attractive option for those looking for temporary financial protection, such as during the years of mortgage payments or child-rearing. However, once the term expires, the policyholder has no coverage unless they renew, which usually comes at a higher premium based on their current age and health.

In contrast, whole life insurance offers coverage for the entire lifetime of the insured, as long as the premiums are paid. This type of insurance not only provides a death benefit but also accumulates cash value over time, which can be borrowed against or withdrawn. While whole life insurance tends to come with higher premiums, it serves as a long-term financial strategy that can support beneficiaries in the event of the policyholder's death. Understanding these differences will help individuals make informed decisions based on their personal financial goals and needs.

The Ultimate Guide to Choosing the Right Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, especially with the myriad of options available in the market today. To simplify this process, it’s essential to first assess your healthcare needs. Consider factors such as your age, medical history, and any anticipated healthcare services in the coming year. Are you someone who needs regular check-ups and prescriptions, or do you primarily seek coverage for emergencies? Understanding your individual needs is the cornerstone of selecting a plan that works for you.

Once you’ve assessed your needs, the next step is to compare different plans. Look for key factors such as premium costs, deductibles, co-pays, and out-of-pocket maximums. Create a comparison table to visualize these details, making it easier to assess which plan offers the best value for your situation. Additionally, don’t forget to verify if your preferred doctors and facilities are in-network, as this can significantly affect your coverage and overall experience.

Are You Overpaying? Comparing Homeowners Insurance Policies

As a homeowner, securing the right insurance policy is crucial for protecting your investment. However, many individuals unknowingly overpay for their homeowners insurance due to a lack of understanding of the coverage they truly need. It's essential to compare various policies to ensure that you're not paying for extra coverage that doesn't benefit you. Start by assessing your home's value, the cost of replacing your belongings, and any specific risks associated with your location. Once you have this information, you can accurately compare policies and understand the coverage limits offered by different providers.

When comparing homeowners insurance policies, consider the following key factors to avoid being caught in an expensive trap:

- Deductibles: A higher deductible often means lower premiums, but ensure you can afford to pay it in case of a claim.

- Coverage Types: Make sure to include necessary coverage options such as liability, dwelling, and personal property to avoid gaps.

- Discounts: Look for available discounts such as bundling with auto insurance or having security features in your home.

By thoroughly examining these aspects, you can identify any potential savings and make certain that you are not overpaying for your homeowners insurance policy.