88YTY News Hub

Stay updated with the latest trends and news.

Term Life Insurance: The Safety Net You Didn’t Know You Needed

Discover why term life insurance is the essential safety net you never knew you needed—protect your loved ones today!

Understanding Term Life Insurance: How It Protects Your Family's Future

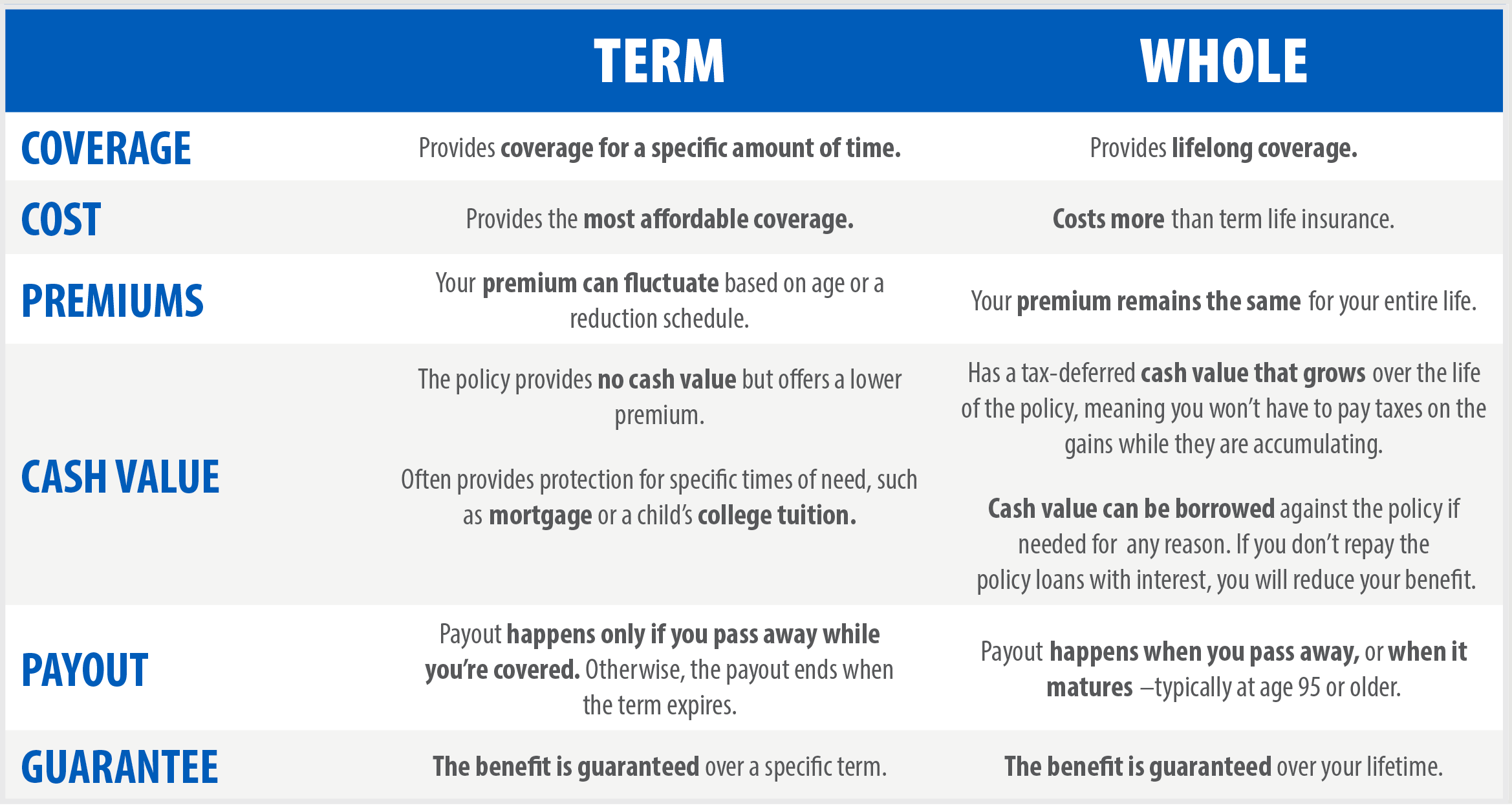

Term life insurance is a crucial financial product designed to provide protection for your loved ones in the event of an untimely death. Unlike whole life insurance, which offers lifelong coverage and includes a cash value component, term life insurance is purchased for a specified period, typically ranging from 10 to 30 years. This type of policy can serve as a cost-effective way to ensure that your family is financially secure when they need it most, covering essential expenses such as mortgage payments, children's education, and daily living costs. For more insights, visit Investopedia.

In the event of the policyholder's passing during the term, beneficiaries receive a death benefit that can be used to maintain their standard of living and manage financial obligations. It's essential to evaluate how much coverage you need based on factors such as your family's lifestyle, debts, and future goals. Additionally, some policies offer the option to convert to permanent insurance later on, providing flexibility as your family's needs evolve. To learn about different types of life insurance and their benefits, check out NerdWallet.

Is Term Life Insurance Right for You? Key Factors to Consider

When considering whether term life insurance is right for you, it is essential to evaluate several key factors that align with your personal and financial goals. First, assess your current financial responsibilities, such as mortgages, loans, and dependents. If your family relies on your income to maintain their standard of living, a term policy can provide a safety net during your working years. According to NerdWallet, determining the right amount of coverage is crucial to ensure that your family is financially secure in your absence.

Another important consideration is the duration of coverage you need. Term life insurance typically offers coverage for a specified period, usually ranging from 10 to 30 years, which makes it an attractive option for those seeking affordable premiums. This type of policy is particularly beneficial for individuals in their prime earning years or those with specific long-term obligations, like funding a child's education. To understand more about the benefits of term life insurance versus whole life insurance, check out Investopedia.

The Benefits of Term Life Insurance: Why You Should Get Cover Today

Term life insurance is an essential financial tool that provides peace of mind and security for you and your loved ones. One of the primary benefits of term life insurance is its affordability; term policies typically offer higher coverage amounts at lower premiums compared to whole life insurance. This makes it easier for individuals and families to secure the coverage they need without breaking the bank. Additionally, term life insurance offers flexibility in choosing the policy length, allowing you to select a term that fits your personal situation, whether it's 10, 20, or even 30 years.

Another key advantage of term life insurance is its straightforward nature. Unlike permanent life insurance, which can be complex, term policies are simple to understand and manage. They provide a clear payout in the event of death within the term. This can be particularly beneficial for young families looking to protect their financial future or adults wishing to cover specific financial obligations, such as a mortgage or education expenses for children. By investing in term life insurance today, you ensure that your loved ones are financially safeguarded against unexpected events.